Banknotes are something very important to the health of an economy, symbolizing a level of confidence and national identity in economic stability. Due to several factors and aspects, central banks from time to time update and redesign banknotes to ensure that their respective currency remains secure, functional, and representative of the values of a nation. While these changes do take place, they may be regarded by the general public as cosmetic changes; quite contrary, as they more often than not come with deep economic and security implications.

One of the major causes for replacing banknotes is counterfeiting. The better technology gets, the closer to reality counterfeiters can get in terms of making money. Outsmarting them, central banks issue new notes with holograms, watermarks, and microprinting as state-of-the-art security features. This renewal will avoid corruption of the currency and give confidence to the public about this means, thus avoiding mass economic fraud.

The other drivers would be the need to mop up currency stored in households, which is kept out of circulation. Most economies have people who hoard cash at home, especially when times are so unsure. These notes outside the formal economy form part of the inflationary pressure since the central bank has to print more money to meet the demand in circulation. The re-issuance of banknotes, for instance, may give an added motive for any citizen to return old banknotes in exchange for new ones-a sort of "mopping up" of hoarded money. That would bring into circulation money lying idle and give good liquidity management a fillip whereby dispensable rises in money supply are avoided and do not feed inflation.

Besides controlling hoarding of currency, central banks replace banknotes to make them more durable. Due to handling, paper notes wear out rather easily, especially in high-circulating economies. The adaptation to polymer banknotes has become quite common because they can last longer, are resistant to damage, and save the need for very frequent replacements, which in the long run would translate to saving and increased sustainability.

Still, another key factor that shapes the redesign of the currency is economic adjustments. In periods of high inflation, smaller denominations are usually unable to perform their function and are replaced by higher denomination banknotes by central banks in order for transactions to remain comfortable without worrying about carrying bundles of cash while making petty purchases. Economies that remain stable, on the other hand, undergo a reprocessing of the structural format of the currency denominations for better fulfillment of business needs and customer needs.

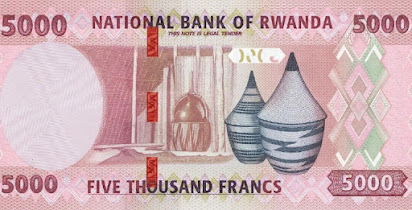

Such banknotes often carry the heritage and identity of a country. In this respect, every redesign of the currency issued by any central bank is hailed as an opportunity to celebrate some sort of cultural milestone, national hero, or historic event. While it may appeal to a sense of unity among the populace, more importantly, it will keep the currency relevant to modern society. Banknote imagery projects a nation's pride and values as a form of soft diplomacy.

Banknote substitution is anything but trivial. Changes in banknotes serve the purpose of making the currency secure with anti-counterfeiting measures, bringing hoarded money back into circulation through economization in order to fight inflation, and reducing costs due to increased durability. The introduction of this sort enables a central bank to respond to the changes in economy and national identity in the most relevant way. It is these changes that contribute to financial system stability, confidence in it, which can only promote a healthy economy and enable the economy to function for a long time.

Comments

Post a Comment